Nothing matches the comfort of our own home. And thus, having that coveted ‘own space’ which we can call a home is a dream for many. But to convert it into reality needs diligence, financial commitment, and hard work. Purchasing a home can be a challenging task for first-timers. As a first-time homebuyer, one needs to be very careful and understand all the processes involved. One needs to give one’s effort and time while looking for a home. Be it your budget or the life of the building – you need to know everything inside out.

Given such critical aspects of home buying, here are some of the aspects that you must look upon while buying a new house for the first time:

1. How big should the property be?

Homes with bigger space do allure us with the spaciousness, but do you really need that much space? There are several factors that you should look into while considering the size of the house. How many family members of yours will live there? How many guests can the house accommodate? Your future plans? Are you buying the home for self-use or is it for investment purpose? Most importantly, does it match your budget? Find the answers to these and you can decide the perfect size of the residence in no time.

2. Floor rise

If you are looking for a flat or apartment, this one is particularly for you. Builders often impose a high rate per square foot for the flats that are located above in the high-rising construction. This tells that the flats on the ground floor are comparatively cheaper than the ones located above. You should also keep in mind that the corner flats are often sold for a premium. When you look for a home you should also notice and make sure that the builder is adhering to the standardised set of rules laid down by the government for residential apartments in the National Building Code1. For example, as per NBC2 India 2005, the height of all standard rooms for human habitation shall not be less than 2.75 metres from the floor surface to the lowest point of the ceiling. There are other similar general building requirements3 which you as a first-time homebuyer should be aware of.

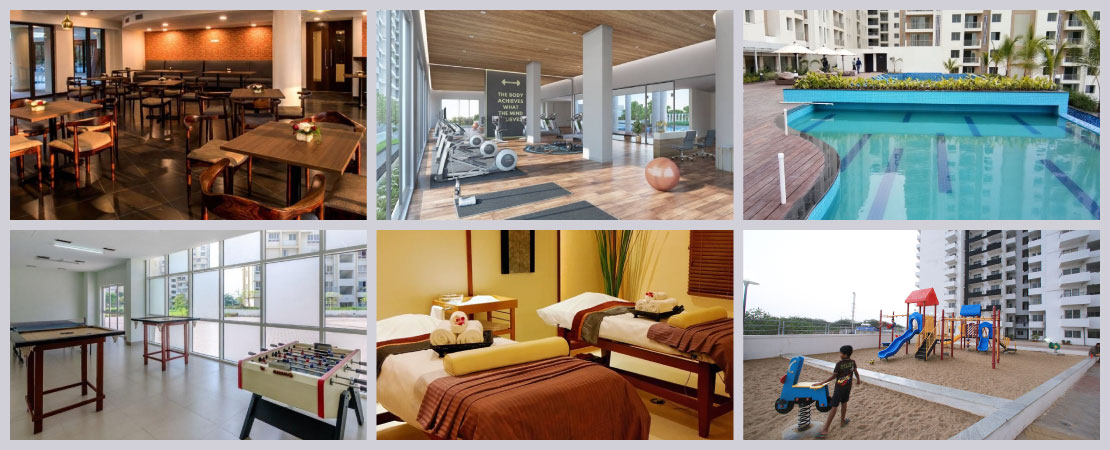

3. Look at the facilities available in the premise

Modern housing has changed the mindset of the people. Hence, nowadays housing complexes are coming up with varieties of luxuries such as clubhouses, gym, swimming pools, game rooms as well as spas. However, the more the amenities, the more is the cost & maintenance issues. While buying a house, you should carefully look for these luxuries and whether they are suitable for your lifestyle or not (or do you even need them or not). For example, if you have a small child, then having a complex which has a park or a game room can be a quality investment. Also do not forget to check for the parking facilities if you have your vehicle.

4. Location is of prime importance

How far is your office from your home? How far will the children have to travel while going to school? Is the market near? Is there a hospital nearby? The location will depend on the answers to these questions. Some people do not own a personal car or bike, and if you are one of them then you must keep in mind the ease of access to public transport systems like taxi, bus, auto and metro stations or a railway station. All these factors are crucial, and so you must look into them very carefully. After taking care of these factors, you should also make sure that the place has grocery stores and other markets that are necessary for daily household.

5. How reputed is the builder or the promoter?

Before purchasing a flat or a readymade home, you must have a look at the track record and reputation of the promoter or the builder from whom you are planning to buy. Find out whether they have a good reputation in the market for completing the projects on time or whether people regret after getting the key to their abode delivered to them. Make sure to know where the builder stays as that can help you in case of an emergency. Check whether the project is registered under RERA (HIRA for West Bengal4).

6. Funds for your dream home

When it comes to real estate, affording them comes with a cost. To be able to buy your dream house, you need funds. While you may have some savings that you can use in fulfilling the down payment but you may have to take the help of a home loan to fill the gap. When you do so, be careful that you take the loan from a reputed housing finance organization that offers timely disbursals and sanctions, gives reasonable charges, and long tenure loans. A home loan helps you to make your dreams come true as well as gives you tax benefits.

7. Property Insurance

Property insurance protects your financial future in case of any damage that happens to the property. The insurance cost is comparatively low and provides coverage if there is a problem with the property or damage and legal issue. There are several insurance policies that you can choose according to your requirements. Choosing proper house insurance helps to protect the property.

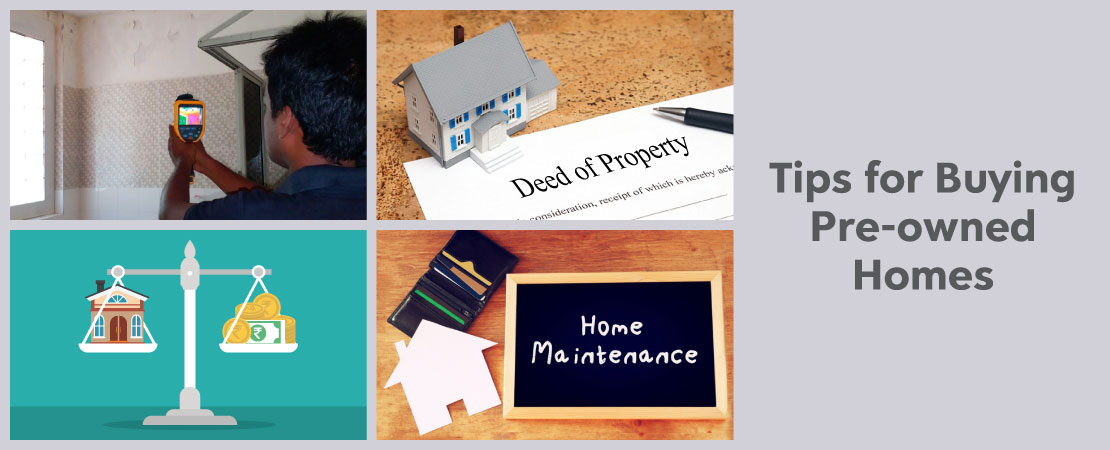

While some people plan to buy their own house, some are there who buy a pre-owned home. If you are planning to buy a pre-owned home, you should make sure that you inspect the legal and structural soundness to avoid problems in the future.

Here are some more tips that you must additionally follow if you are planning to buy a pre-owned home..

1. Check the real condition of the surfaces

A beautiful exterior may hide severe damages. One who wants to sell a house will make sure that the paint is more or less proper and not peeling off but there might be critical problems beneath. You should hire a trusted professional – a home inspector – who has in-depth knowledge about this and will be able to spot the underlying issues. After the inspection is done, chances are that the house may need a renovation. After assessing the damages consult with an expert for estimating the cost of renovation.

2. Look through the property’s past

In some cases, the one who is selling the property might not be the actual owner of the flat. You need to trace the ownership depending on the age of the property. For doing this you must consult a lawyer who is eligible to prepare a report on the particular property. The one who owns the property must have possession of the original documents. The amount of the property should be equal to the value of the property.

3. Do some bargaining

In most cases, the owner of a property might be under some pressure to sell the flat or the home; so it is important to bargain which can come to your benefit. Identify the defects carefully and then press the owner for additional discounts. And if there is a need for renovating, then that can get you a good deal. Second-hand houses in Mumbai are 5% less costly than the new projects while properties in Chennai, Gurgaon, and Bangalore are 10% to 15% lesser than the new ones.

4. Check for prospects, fees

Before signing the legal documents, make sure that you look through the maintenance fees and the parking charges that you have to deposit. Be it a new house or an old one, any house that you buy is probably one of the biggest investments of your life. So, do not forget to ask the property dealer about how much the property would be worth after ten years and more.

Let’s not forget to have a look below the surface

Outside the house

- Check the walls properly, and make sure that there is no dampness. Fresh paints might hide the damages.

- Tap all the woodwork, especially windows and doors. If there is a problem with that like hollow sound or dust coming out, then talk with the owner.

- Examine the water supply systems very carefully.

- Make sure to check the drainage system of the building.

Inside the house

- Check for water leaks, and other suspicious means inside the house.

- Carefully examine the walls, whether there is any damage or bulk or maybe crack on them.

- Check the closed spaces for any kind of fungal growth.

- Open the tap to see if there is any kind of problem with the plumbing.

- Ask for the layout and the age of the wiring from the housing society or owner.

Finally, get a Health & Safety Check-up of your Home – Opt for a home inspection

A hitherto alien concept in the Indian market, Home Inspection is now gaining popularity at a rapid pace. There are many firms specialising in property inspection services today. They take the onus of examining every inch of the property that you are buying and spot the defects that you may otherwise overlook. Equipped with the right knowledge and advanced tools, they come up with suggestions that save you from future home-related problems and recurring expenses.

So, all you need to do before buying your first home is doing a bit of research and the experience is bound to turn into a satisfactory one.

Coming back home, sitting on the front porch and sipping freshly brewed coffee – sounds welcoming? You are all set to own a home if you have considered the above facts. If you haven’t done that till now, get geared up and start your search for the perfect home.

Reference links used:

1. https://housing.com/news/national-building-code-india-residential-apartments/

2. https://www.thehindu.com/features/homes-and-gardens/No-ceiling-for-ceiling-heights/article14675568.ece

3. http://mohua.gov.in/upload/uploadfiles/files/Chap-4.pdf

4. https://hira.wb.gov.in/district_project.php?dcode=10001000000032