Not every masked object will be as vigilante & handsome as Antonio Banderas as in the 1998 Hollywood film-The Mask of Zorro. Your home can also be the safe haven of one or many masked entities. Sometimes a masked entity can be a hotspot of future issues waiting to lift its dangerous head to strike at its suitable moment or pierce its false teeth into your Home Sweet Home. Basically the masked structures take refuge or take birth due to various reasons unknown to the inhabitants of the home. Also since they are masked, it is neither possible nor feasible for a common man to even get a bit of idea about it. Or may be it is possible…… let us see how…

Every house has seven basic elements – walls, ceiling, floor, doors, windows, plumbing and electrical. These elements can conceal issues which as mentioned earlier can become humongous or pose serious threat in the proper functioning and safety of your home.

Many a times when the symptoms come to the forefront, the damage is already done or it’s too late.

‘Enough of Hide and Seek… now it is time for you to confront them head on.’

Walls: Yeh deewar tootni nahi chahiye

1. Hairline Diagonal crack – Most of the diagonal cracks portray building settlement and defects in building design. Diagonal cracks originate as hairline cracks on wall surface, but with time it gradually increases in length and depth. These cracks if not treated at the right time will gradually increase in depth and effect the building stability.

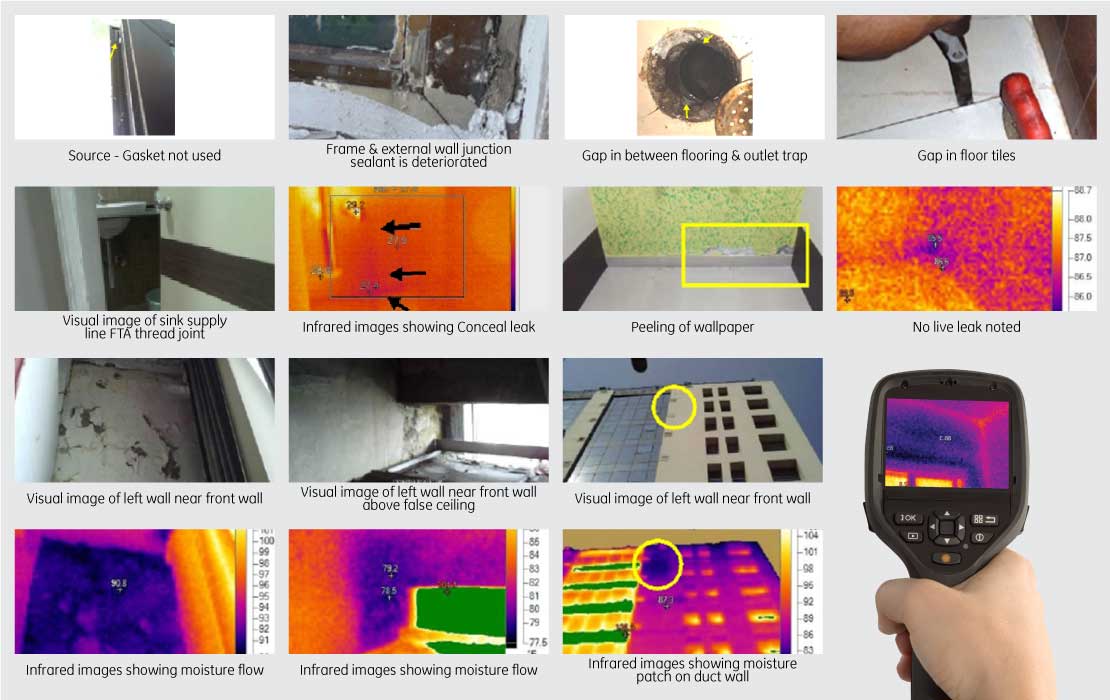

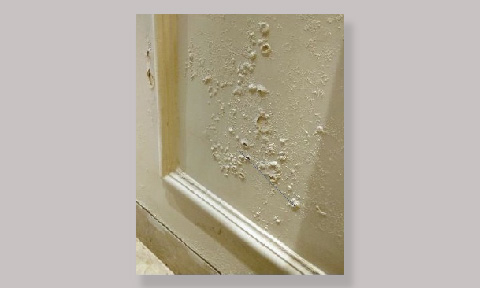

2. Hollowness in plaster surface – Newly painted walls does not forecast the condition of plaster surface beneath. Hollowness on plaster surface portrays the loss of stability of the wall surface due to thermal changes, moisture intrusion and multiple developing cracks. If not rectified at right time, this will gradually lead to collapse of the plaster surface and affect the habitability of residents living inside.

3. Finishing of External Wall – If the external wall has paint finish with exterior grade paint : #1 – prior to adequate curing of external wall surface plaster, #2 – on hollow plaster surface, will lead to inadequate bonding between paint and plaster surfaces. In the long run due to climatic changes and weathering action, moisture intrusion will occur in the deteriorated plaster and paint surface and will seep inside house. (Read our blog: Moisture / Damp / Seepage – The Invisible Silent Killer: Unsuspecting Criminal – https://macj-abuyerschoice.com/real-estate/moisture-damp-seepage-invisible-silent-killer-unsuspecting-criminal/)

Ceiling: Ceiling should be sealed

A smoothly painted false ceiling can hide:

- Leak from roof or above floor for few months. After that some discoloration > popping of paint > peeling > Termite / insects > water droplet > collapse of false ceiling.

- An inadequately supported false ceiling; which will lead to sagging of false ceiling.

A painted ceiling over RCC can hide:

- Loose plaster / hollow plaster – which will start to peel off / collapse.

- Rusted reinforcement (which is the back bone of the building); building with Rusted reinforcement is structurally not stable.

- Hide leak from roof or above floor for few months. After that some discoloration will occur & eventually lead to damage.

Floor: Keep your feet firmly on the ground!

1. Hollowness – It causes damaging of flooring surface either tiled / marble/ CC. Causes are due to uneven preparation of underlayments. Under the impact of super imposed load like furnitures, it may get damaged. Refilling / Relaying / rectifying the hollowness is possible. But the rectifications are costly as marble finish will require epoxy base materials where as similar shaded tiles are required in case of tile work.

2. Uneven Tile – It is visible but usually granted as minor issue hence neglected. Causes are due to uneven laying of tiles and sometimes curvature at tile edges by manufacturer itself. Rectification can only be done by relaying similar shaded tiles for uniformity.

3. Slope of flooring at wet areas and atmospherically exposed areas – It is also not visible unless inspected properly. Causes are due to improper levelling of flooring and poor workmanship. Water stagnancy / pocket/ accumulation/ catchment are some defects which lead to seepage and major damages in longer duration.

Door: Lock kiya jaye?

1. Stability – It is the prime technical aspect of a door, which is a prime form of security for occupants. Spalling of plaster, rattling of frame, distinct gap at frame joints are some symptoms which are caused due to stability issue rather than resistance to sudden impact. Inadequate anchorage frame fastener/ clamps/bracings/base support which is concealed at frame and adjoined wall/floor surface are invisible to naked eyes, hence stability of frame cannot not be easily assessed in a new flats/ houses.

2. Rottening of frame bottom portion – It is caused due to lack of seasoning of solid wooden frame and also if not treated properly at concealed bands of jamb. In the long run it’s been observed that wet patches arise at bottom portions and paint deterioration at adjoined painted wall surface. It also impacts the stability as higher the moisture content at wood leads to decay and expansion of intermolecular spaces, it loses the grip with anchorage fasteners/ clamps.

3. Rattling of door panels after locking – It is caused due to poor workmanship in installing the panel rather hinges and can be checked by providing PVC groove casing at jamb groove position for latch bolts. In the long run, separation gap can be observed as continuous rattling can affect the stability of door frame and even cause bending of panel in worst cases.

Window: A window is a gateway to opportunities, but only for yourself! / Open the window to let the sun and breeze in, good for us.

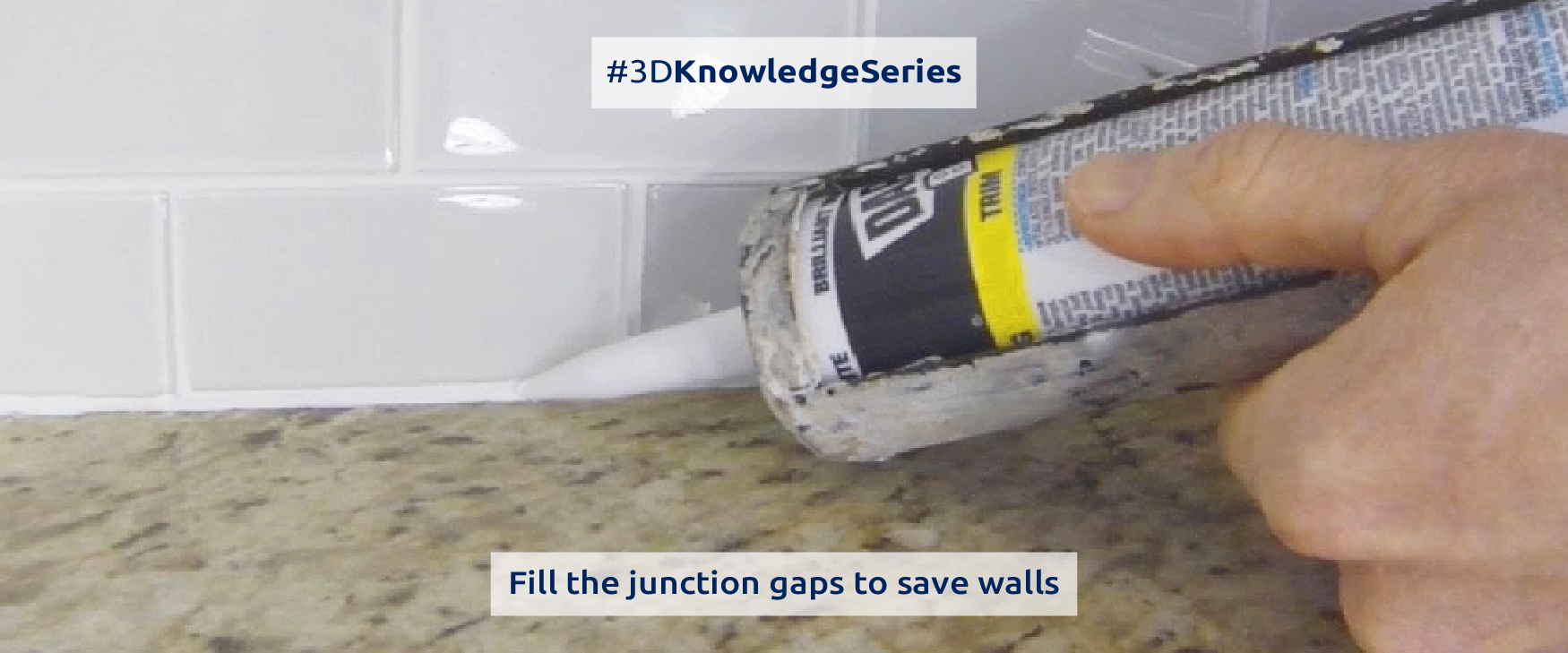

1. External gap around window frame – It can cause severe intrusion of moisture / water from the gaps and deteriorate the window frame with adjoined wall components.

2. Choosing of glass panes and panels – Shattering of glass panes can cause accidents to occupants or pedestrians below. Variety of toughened glass is available in market to suit one’s need.

3. Safety approach – Window sill if below particular height, then additional grill or fixed panel to be provided to restrict tripping off. Mostly found in bathrooms and common areas. But needs to be taken care as it might get fatal.

4. Drip mould at chajja – It restricts the flushed water from vertical external wall surface from splashing inside the unit. This minor work is neglected and we often see that box window with no drip mould are prone to seepage / moisture intrusion.

Plumbing: Plumber wale Babu mera pipe thik kare dey

1. Concealed leakage – Plumbing lines are mostly concealed at wall or floor surface, invisible through bare eyes. It occurs due to poor workmanship during installation, poor joint packing compound/ material, lower grade pipes/ corrosive pipes, over lapping, wearing due to time lapse. It will show wet patches at painted wall surfaces portions around the wet area, rising dampness above skirting level of painted wall surface, stains at bathrooms wall finishing.

2. Grouting – Being the most integral pipe fitting component, it is important to provide non-shrinking, workable and high strength grouting component. The floor outlet position, wall insertions needs grouting else water infiltration will occur and travel along the floor bed mortar level and effect lower floor occupants by water percolation from ceiling, rising dampness at surrounding walls, dirt accumulation and flooring joint filling deterioration around.

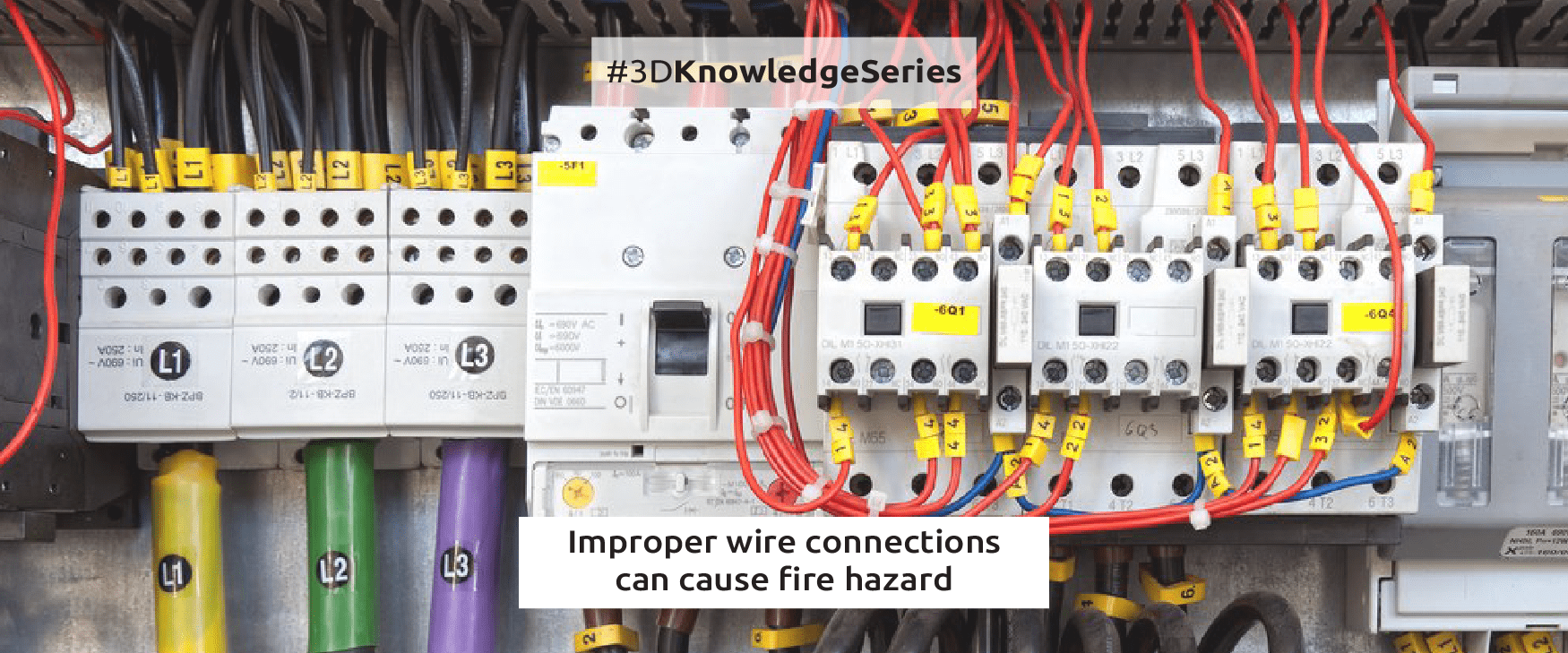

Electrical: Be an Electrical Safety hero. Score an accident zero

- Loss of current – Generally wire passing is conveyed by conduits running concealed inside wall/ ceiling/ floor surfaces – Practically not visible with bare eyes. If any damage occurs at concealed wiring during home renovation or wire pulling, electric loss will occur and human conduction can even be fatal.

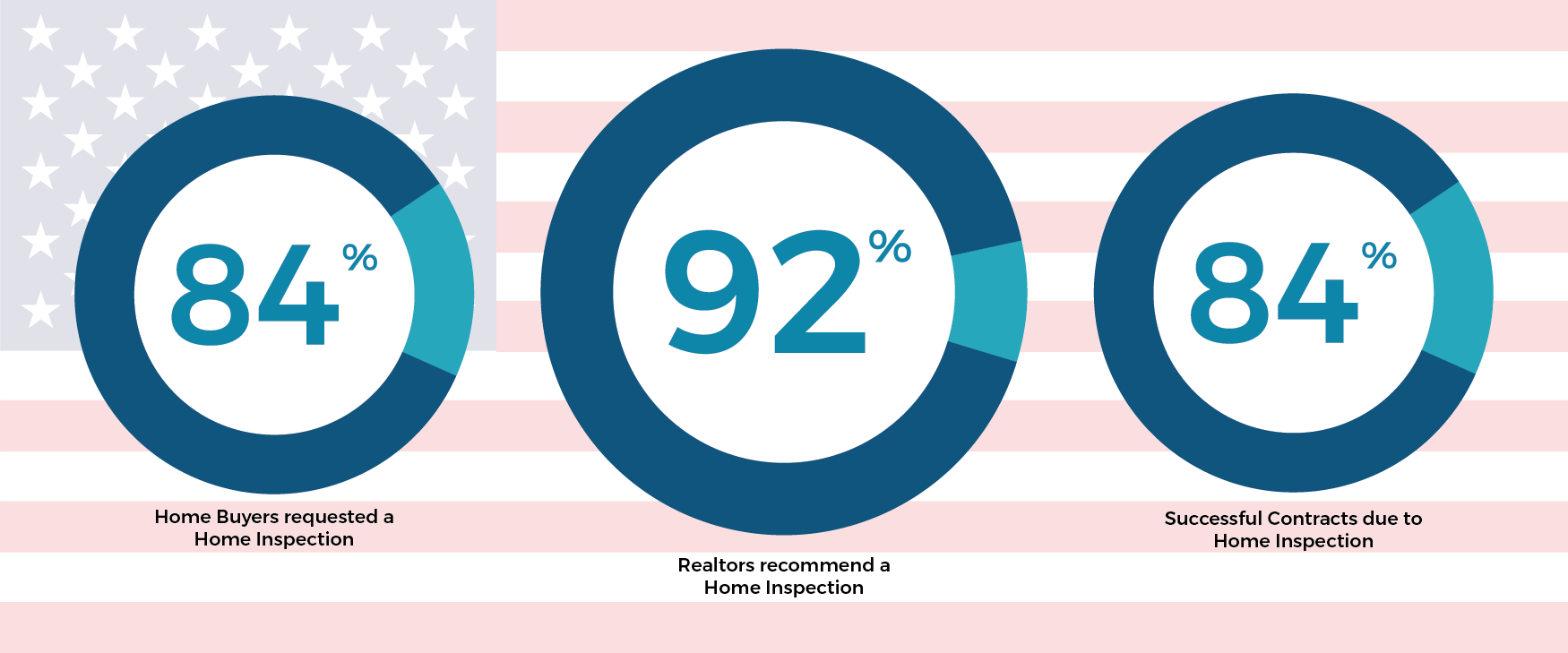

Your home should be filled with happiness in every nook and corner. Our sole motive is to keep your home hale and hearty and hence we want you to know what can be hidden behind every element. We do not want you to get distraught and get worried regarding one of the biggest investments that you have made or might make in your life. So it’s better you unmask the issues rather than waiting for the issues to unmask themselves. Be wise and get your home inspection done at the right time.